maryland student loan tax credit 2021

Try it for Free Now. Complete Edit or Print Tax Forms Instantly.

States Step In Relieving The Burden Of Student Loan Debt Rockefeller Institute Of Government

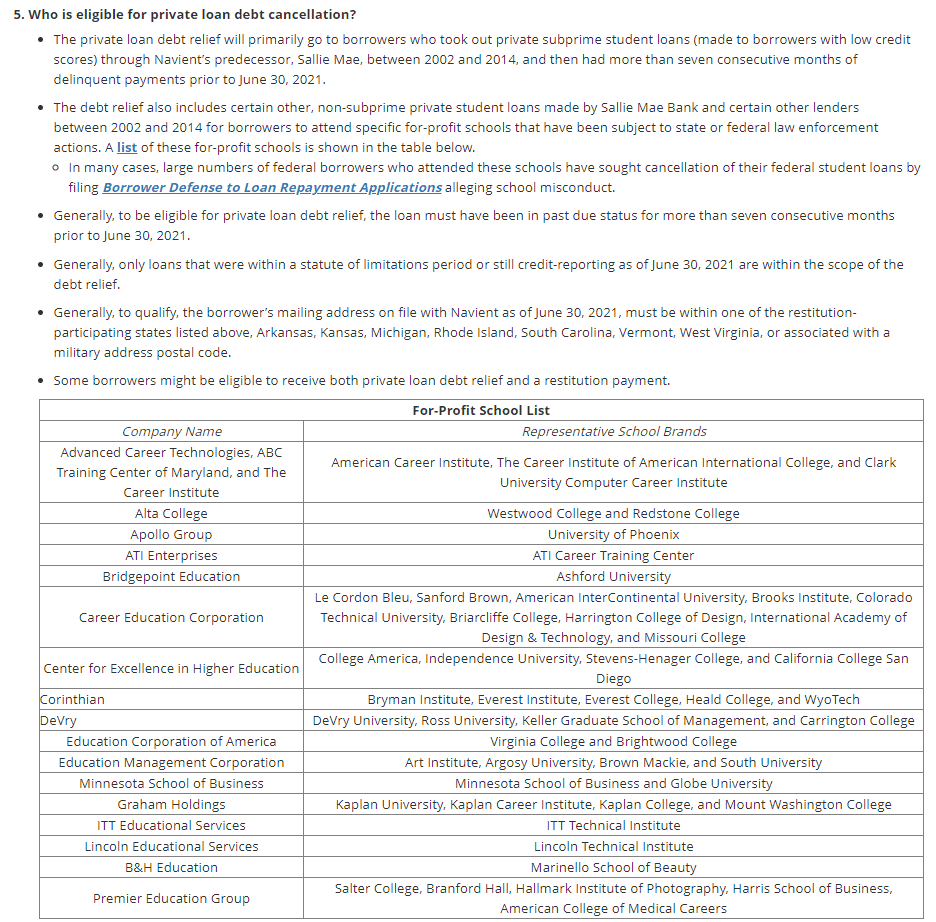

Have at least 5000 in outstanding student.

. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Or ii the State income tax imposed for the taxable year calculated before the application of the credits allowed under. Enter the Maryland tax from line 21 Form 502 or line 11 Form 504.

If the credit is more than the taxes you would otherwise owe you will receive a. With this program youll be able to deal with the various types of tax problems such as garnishments on wages tax penalties personal and business taxes and back taxes trust fund. Have incurred at least 20000 in undergraduate andor graduate student loan debt.

This is the Maryland tax based on your total income for the year. Browse discover thousands of unique brands. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

Student Loan Debt Relief Tax Credit. File 2021 Maryland state income taxes. To qualify for the tax credit applicants who attended a Maryland institution must have filed their state income taxes and have a student loan of at least 20000 while.

Upload Modify or Create Forms. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Maintain Maryland residency for the 2021 tax year. To be eligible for the Student Loan Debt Relief Tax Credit you must. The one-time credit payment varied between 875 and 1000 The.

Student Loan Debt Relief Tax Credit. For any taxable year the credit may not exceed the lesser of. The site outlined that in 2021 close to 9000 residents of Maryland applied and received the tax credit.

Read customer reviews best sellers. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. August 24 2022.

ANNAPOLIS MD Governor Larry Hogan today announced nearly 9 million in tax credits to more than 9000 Maryland residents with student loan debt awarded by the Maryland. Use e-Signature Secure Your Files. To qualify for the tax credit applicants must have filed state income taxes in Maryland and have amassed a student loan of at least 20000 while maintaining 5000 or.

Those who attended in-state institutions received 1067 in tax credits while eligible. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept.

Tax on amount on line 3. Have incurred at least 20000 in undergraduate. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to.

The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. For tax obligation debt problems the circumstance is a lot more significant as a result of the increased collection rights the internal revenue service and also State have. Ad Register and Subscribe Now to work on your Peoples State Bank Business Loan Application.

In 2021 9155 Maryland residents received the Student Loan Debt Relief Tax Credit.

How To Get Navient Student Loan Forgiveness The Complete 2022 Guide

Learn How The Student Loan Interest Deduction Works

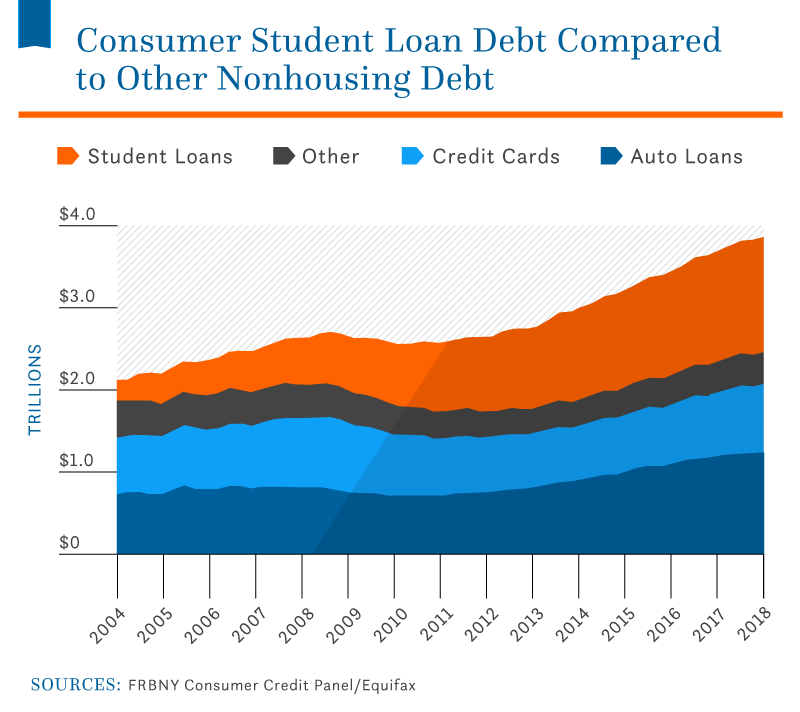

Student Loan Debt 2022 Facts Statistics Nitro

Prince George S County Memorial Library System Applications For The Maryland Student Loan Relief Tax Credit For 2021 Are Due Tonight At 11 59pm Et If You Meet The Criteria Apply Great Opportunity

Marylanders Have Less Than One Month To Apply For Student Loan Debt Relief Tax Credit Wbff

Information On How To File Your Tax Credit From The Maryland Higher Education Commission

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Maryland Student Loan Forgiveness Programs

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Howard County Executive Calvin Ball Do You Have Student Loans Maryland Taxpayers Who Have Incurred At Least 20 000 In Undergraduate And Or Graduate Student Loan Debt And Have At Least 5 000 In

Comptroller Implores Marylanders To Apply For Student Loan Tax Credit Afro American Newspapers

Quick Guide Maryland Student Loan Debt Relief Tax Credit

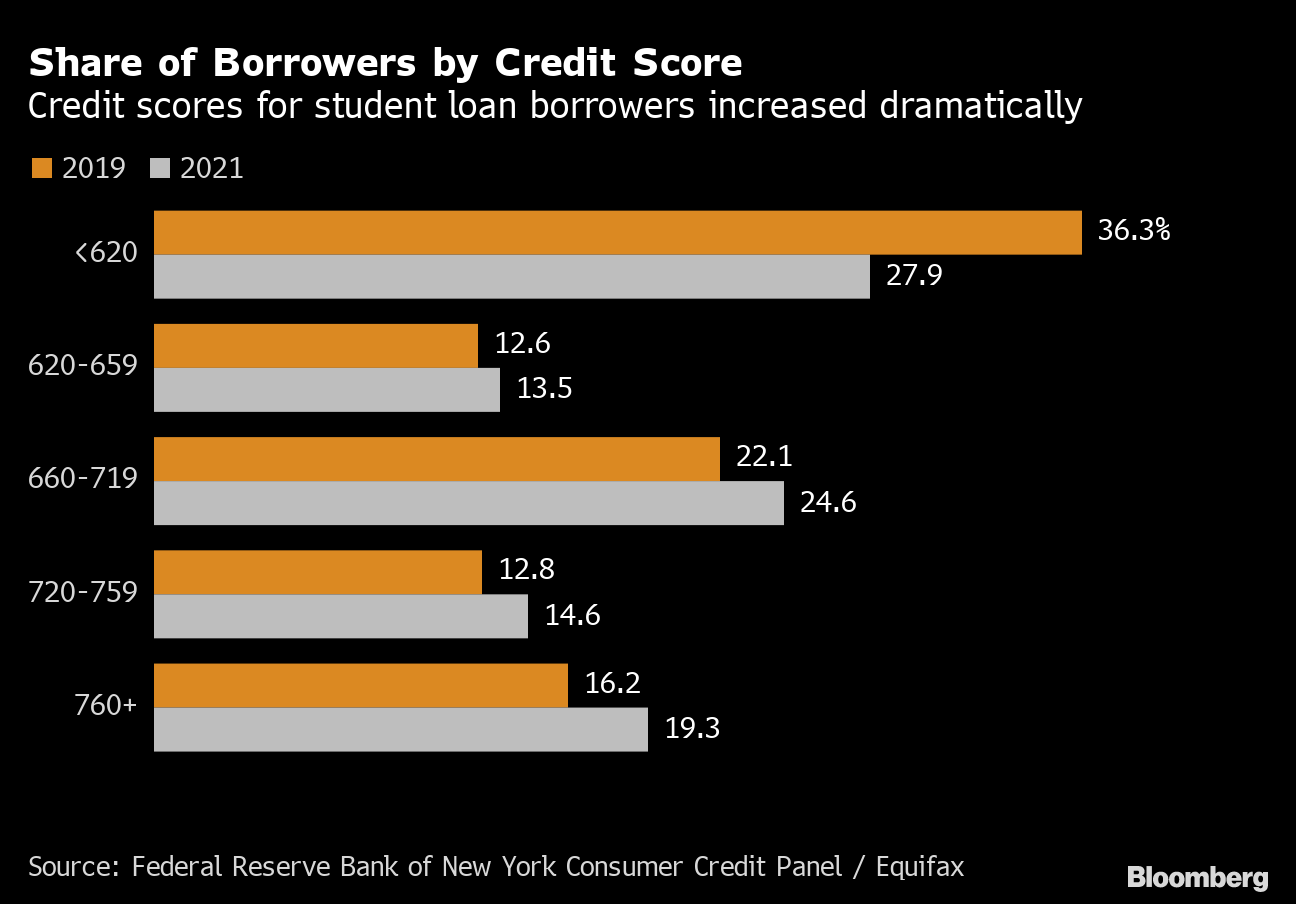

Student Loan Moratorium Boosts Credit Scores Especially For Delinquent Borrowers Bloomberg

A Simple Tool Has Brought Health Insurance To Thousands The Pew Charitable Trusts

Mackey S Financial Services Home Facebook

Vita Free Tax Preparation Human Services Programs Of Carroll County