property tax assistance program nj

The filing deadline for the 2018 Homestead Benefit was November 30 2021. In July more than 260000 older homeowners renters and people with disabilities started receiving part of a massive 1217 million payout issued through the Property TaxRent.

The Official Website Of City Of Union City Nj Tax Department

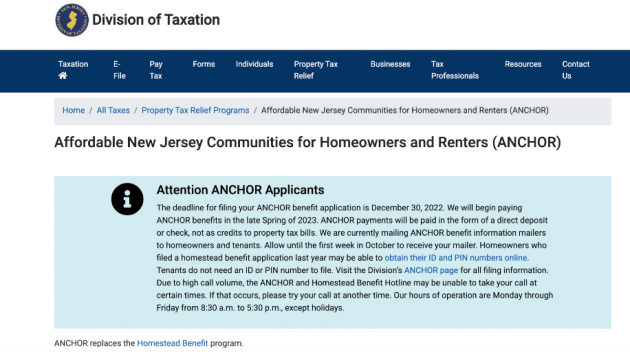

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program.

. If your income was between. Oliver today announced the upcoming launch of the Emergency Rescue Mortgage Assistance Program ERMA on. You can also email the ERMA team at HAFServicingnjhmfagov or call us at 855 647-7700 between the hours of 830am and 530pm Monday through Friday.

Kiely said if your 2014 income was 100000 or less your rebate is your 2014 real estate tax multiplied by 15 percent with a maximum rebate of 1000. New Jersey has launched a new program to help homeowners and renters save on property taxes. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

This program provides property tax relief to New Jersey residents who owned or rented their principal. ANCHOR eligibility is as follows. COVID-19 is still active.

The Boards other functions include the annual. Stay up to date on vaccine information. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and met these income requirements.

When is the application deadline. Currently the youngest member of the NJ State Senate and the first. Who is eligible for the ANCHOR program.

This is a rental assistance program offered by New Jersey for low-income families individuals single. New Jersey homeowners struggling to pay their mortgage or property taxes can apply for up to 35000 in aid when the state opens its application portal on Feb. The deadline is December 30 2022.

Our hours of operation are Monday through Friday from 830 am. Under the Murphy Administration New Jersey has seen the lowest cumulative average property tax increase on record for a governor at this point in his or her term. Eligibility Requirements and Income Guidelines.

The Emergency Rescue Mortgage. The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on. The ANCHOR program short for the Affordable New Jersey Communities for.

New Jersey State Rental Assistance Program. The Mercer County Board of Taxations primary responsibility is the certification of property tax assessments. Long-awaited help is coming for homeowners who have fallen behind on their mortgages property taxes and other expenses.

Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several. Call 1-866-588-5696 or 1-800-367-6543. January 24 2022- Governor Philip D.

Property Tax Assistance Programs. Covid19njgov Call NJPIES Call Center for medical information related to COVID. You must be age 65 or older or disabled with a Physicians Certificate or Social Security document as of December 31 of the.

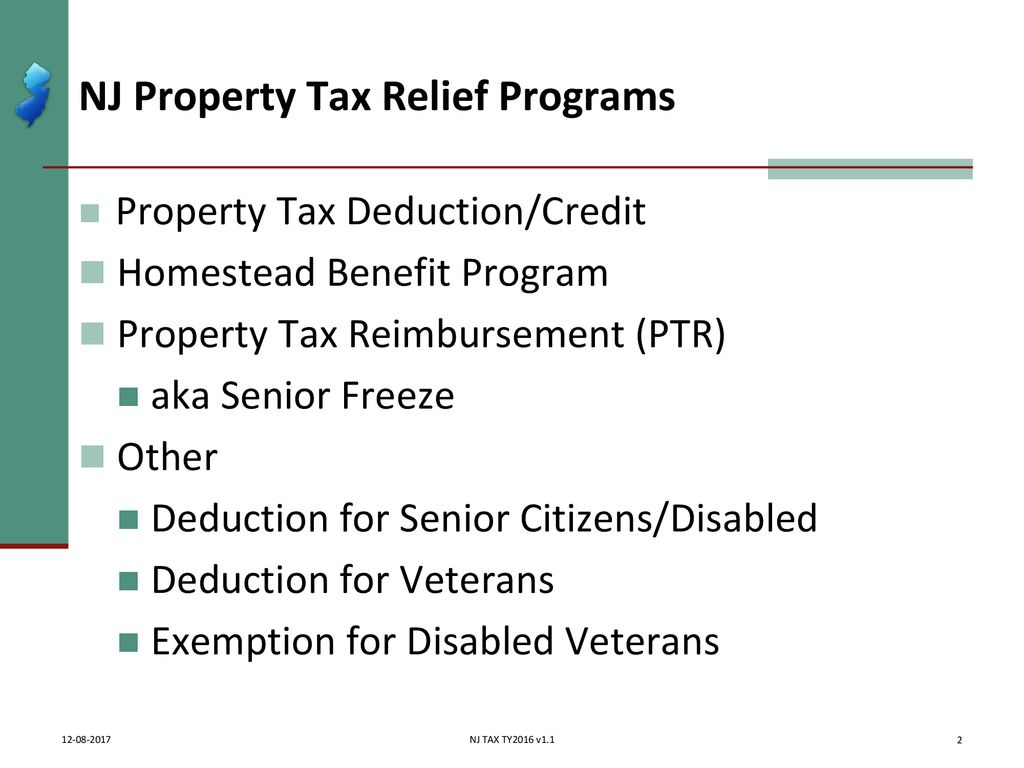

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Nj Gov Phil Murphy Lawmakers Agree On 2b In Property Tax Relief Nbc10 Philadelphia

This Is How Much Property Tax Relief You Ll See In New Nj Program Across New Jersey Nj Patch

New Jersey State Rebates Livingston Township Nj

Borough Of Oakland Encourages Eligible Homeowners And Renters To Apply For Property Tax Relief Through The New Anchor Program Borough Of Oakland Nj

Heads Up Nj Property Tax Relief Applications Start Next Week

Governor Phil Murphy On Twitter With Our New Anchor Property Tax Relief Program We Will Distribute 900 Million To Nearly 1 8 Million Homeowners And Renters Across New Jersey Helping Families And

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Nj Property Tax Break For Seniors In Budget After Agreement

Property Tax Relief Programs Mount Olive Nj

West New York Mayor Encourages Residents To Apply For Anchor Property Tax Relief Hudson County View

Office Of The Governor Governor Murphy Unveils Anchor Property Tax Relief Program

Anchor Tax Relief For Homeowners Renters Nj Spotlight News

News From Woodbridge Township Nj

Nj Anchor Rebate Information Coming Soon To Your Mailbox

Property Tax Assistance Program Available In Franklin County For Those Who Qualify Wtte

Covid 19 Resident Resources Mercer County Nj

Understanding New Jersey S Property Tax Relief Programs Youtube